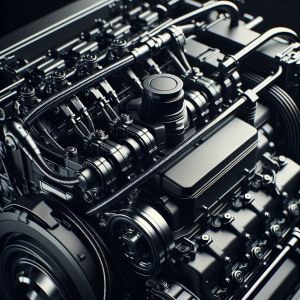

Cummins Inc.'s portfolio (NYSE:CMI) has been attracting considerable attention from numerous financial bodies, leading to movements in its share prices. A range of organisations, including

State Street Corp, Integrated Wealth Concepts LLC, and

Investment Management Corp of Ontario have increased their share holdings in the company. Conversely, others, such as

Janus Henderson Group PLC and

Stifel Financial Corp have offloaded Cummins shares.

Janus Henderson Group PLC has even liquidated all its shares. The stock is currently experiencing a healthy rise, from the aftermath of a successful Q3 earnings report and increased

EBITDA outlook, despite flat revenue. Tech training and adoption of zero-emissions technology feature prominently in the company's strategy, with

Accelera by Cummins being awarded $75 Million for zero-emissions manufacturing. Going forward, Cummins aims to beat EPA 2027 Emission Standards through its Twin Module Tech.

Marina Savelli, new VP of Engine Business, will play a crucial role in this growth. The stock is being highly recommended for long-term investment, owing to its strong momentum and value.

Cummins CMI News Analytics from Mon, 18 Mar 2024 07:00:00 GMT to Sat, 07 Dec 2024 14:35:15 GMT -

Rating 9

- Innovation 7

- Rumor -7