DaVita Inc. (DVA) continues to showcase an interesting mix of performance ups and downs. The general consensus among analysts has been to

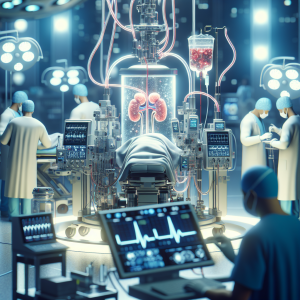

'Hold' DVA. The company's improved relative strength rating and overwhelming year-to-date gains of 40.1% and 47.3% point towards a positive investment climate. However, the stock has seen a few slumps, with shares plummeting post disappointing earnings and steep falls on certain trading days. Despite these, DVA has consistently outperformed medical sector peers. Company-wide changes were observed with new appointments such as David Maughan as

Chief Operating Officer and Jessica Hergenreter as

Chief People Officer. DVA missed Q3 2024 earnings estimates, affecting stock prices negatively, but its robust financial performance, chiefly noted in its Q3 2024 earnings call, helped keep the rally alive. DVA's inclusion and commendable performance in Warren Buffett’s portfolio, positions it strategically well in the market. The stock, hitting a 52-week high, has led to speculation about whether this bullish ascent will continue. Institutions like Geode Capital Management, National Bank of Canada, and Quadrature Capital exited their positions while Goldman Sachs pins it as a long-term AI stock set to rally.

Davita DVA News Analytics from Thu, 02 May 2024 07:00:00 GMT to Sat, 21 Dec 2024 10:09:01 GMT -

Rating 7

- Innovation 3

- Information 6

- Rumor -7