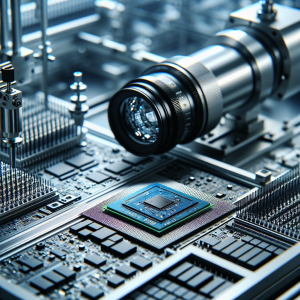

Microchip Technology (MCHP) has been in the spotlight recently due to a collection of updates. These include a short-term rally prediction, launching advanced PCIe Gen 4.0 switches for automotive computing solutions, and recent purchases of shares by Godsey & Gibb Inc., Park Avenue Securities LLC, and Pallas Capital Advisors LLC. Analyst ratings indicate mixed sentiments around the company. Despite better-than-expected Q3 sales, MCHP's

shares traded lower and declined due to a

short-term challenging outlook and lower than expected guidance. The company's Q3 earning are anticipated, as its Q2 earnings were beyond estimates. Microchip Technology has been addressing concerns about its debt and has seen institutional investors shorting their stock. Recent news shows that returns are gaining momentum, but the company's stock has shown some weakness. Additionally,

MCHP is launching

IGBT 7 Devices that will enhance AI Data Center Efficiency. It has also cut its Q4 revenue forecast and plans to close Tempe Fab 2 for savings of $90M. There are various factors at play, including dividend increases, potential caution signs from insiders selling shares, and leadership transitions that investors need to consider.

Microchip Technology MCHP News Analytics from Tue, 23 Jul 2024 07:00:00 GMT to Fri, 17 Jan 2025 09:30:11 GMT -

Rating -2

- Innovation 5

- Information 6

- Rumor -3