Clearbridge Investments adds 185,410 shares of

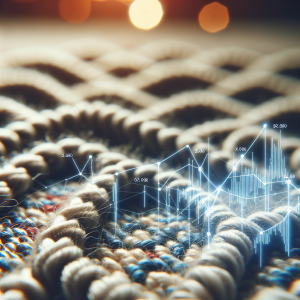

Mohawk Industries (MHK).

Q2 MIHK earnings position the company as a leader in home furnishings.

Jin Cramer sees MHK as a strong buy, and the stock seems to outperform the consumer cyclical sector despite market underperformance. However, a SWOT analysis reveals upcoming market headwinds. MHK shows potential as a top value stock for the long-term, with Q2 results exceeding estimates.

Mohawk's President of their Global Ceramic segment now is

Mauro Vandini.

Subdued growth doesn't hinder MHK share advancement, despite challenging macro backdrop. The company sees a decent 60% return over the past year, with companies such as

Ariel Investments and others adjusting their stake in MHK. The company continues to have a 'hold' rating as earnings approach.

First Quarter 2024 earnings surpass revenue expectations, but lag in EPS. Sustainability progress is highlighted in MHK's 2023 Impact Report. There are concerns regarding insider selling despite increasing stock holdings by different firms. Despite missing revenue for Q2 2024, MHK has received an improved outlook. The company sees a raise in share price after Q2 earnings.

Mohawk acquires Vitromex Ceramic Tile Business from Grupo Industrial Saltillo, forecasting potential growth.

Mohawk Industries MHK News Analytics from Thu, 28 Jun 2018 22:58:07 GMT to Sat, 05 Oct 2024 12:42:23 GMT -

Rating 8

- Innovation 6

- Information 7

- Rumor 2