Regeneron Pharmaceuticals (REGN) faced a series of challenges in Q1 2025, amidst a drop in revenues to US$3,029 million. Several investment firms including Benjamin Edwards Inc. and Bokf Na have increased their holdings whereas some others like Axa S.A. and Ameriprise Financial Inc. cut their stakes. Renowned billionaire investor, Mario Gabelli views Regeneron among his large-cap stock picks with high upside potential.

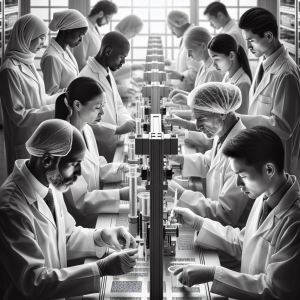

The pharmaceutical giant has been lauded as one of the most innovative biopharma companies by well-known expert Jim Cramer, despite a 7% crash on a major miss for its key eye drug. Although its key drug Eylea's extended dosing got rejected, FDA kept its current 16-week regimen approved. Regeneron has experienced some positives including a massive $7 billion manufacturing push, creating 1000 jobs, and doubling U.S. production power. In addition, it received conditional EC approval for Lynozyfic in multiple myeloma.

However, the company is facing legal pressure and is subject to securities class action. Several analysts have lowered their price targets although they consider it the best biotech stock to buy and hold for 2025.

Regeneron Pharmaceuticals REGN News Analytics from Tue, 05 Nov 2024 08:00:00 GMT to Sat, 10 May 2025 17:26:23 GMT -