Cadence Design Systems (CDNS) significantly surpassed

Q3 estimates and raised its

profit outlook. The leading

semiconductor design software firm's robust performance led to a surge in stock price, putting it top on the S&P 500.

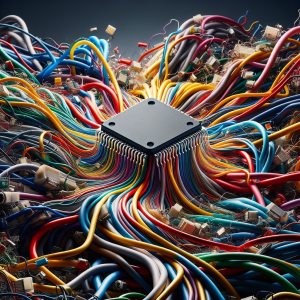

Jim Cramer encouraged investment, emphasizing the company's strong strategic position, working arm in arm with Nvidia. Impressive financial performance and positive future guidance discernibly caught investor attention. Despite some shares selling off by entities like the New York State Common Retirement Fund and Fidelis Capital Partners LLC, the strong sales and profit, specifically, a 6% rise in stock and a Q3 EPS topping by 20c reaffirm significant investor faith in CDNS. Furthermore, their new

Palladium Supercomputer launch and potential in

AI chip design software have also interested the market. Ironically, despite lagging EPS, Cadence's revenue beat expectations, which supported its favorable market performance. Analysts are revising their forecasts in light of the Q3 results, and the price target has been raised to $340.00. Regardless of market uptick causing falls, Cadence remains a trending stock with strong institutional backing (88%).

Cadence Design Systems CDNS News Analytics from Tue, 28 May 2024 07:00:00 GMT to Sat, 02 Nov 2024 10:37:17 GMT -

Rating 8

- Innovation 6

- Information 7

- Rumor -5