Cadence Design Systems, Inc. (CDNS) has been amongst the popular companies in recent investor discussions due to several positive factors. The company shows strong returns on capital, projecting buoyancy for stock performance. Its

recent short interest points to investors' confidence in its stability. It was reported that Stanley Laman Group Ltd., Robeco Institutional Asset Management B.V., Pacer Advisors Inc., and Voya Investment Management LLC, among others, purchased significant amounts of CDNS shares, demonstrating the stock's popularity among large investors. Furthermore, Cadence has been developing as a major player in

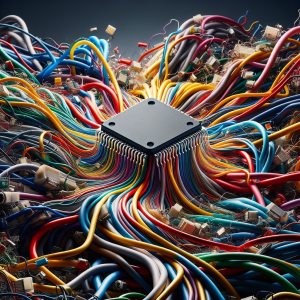

AI chip design, diversifying its market space, which can reflect favorably on its stock value. The company's reported

Q3 earnings exceeded estimates, pointing towards a positive financial trajectory. Additionally, the company's

valuation has been reevaluated after achieving its earnings target, reporting robust growth, and gaining regulatory support in China. Despite some fluctuation in market gains, Cadence has consistently outperformed the broader market. This, coupled with the company's

healthy and strong balance sheet, positions Cadence in a favorable light for future growth potential.

Cadence Design Systems CDNS News Analytics from Thu, 26 Jun 2025 07:00:00 GMT to Fri, 09 Jan 2026 22:50:06 GMT -

Rating 7

- Innovation 6

- Information 8

- Rumor -6