IDEXX Laboratories (IDXX) has attracted the attention of investors and analysts alike. The company is noted for its

strong recurring revenues from consumables and software, yet some analysts suggest the stock may be overvalued. Brokerages'

average recommendation is 'moderate buy', with BTIG Research one amongst multiple institutions initiating coverage of the stock. The

forecast for Q2 2025 earnings stands at $3.19 per share. Notably, the firm's

earnings growth rate appears to lag the returns it delivers to shareholders. In terms of active trades, 1832 Asset Management, Shell Asset Management and Bessemer Group have reduced their holdings, whereas Orion Portfolio Solutions and SG Americas Securities have increased theirs, to name but a few. While the

balance sheet is rock solid, the

aging pet population is considered a solid longer-term tailwind. Yet, shares have sporadically underperformed compared to market competitors, raising concerns amongst certain analysts. The promising launch of

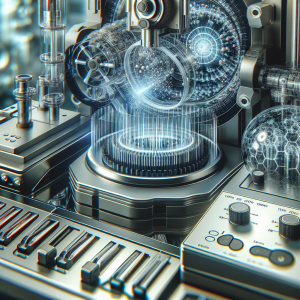

IDEXX inVue Dx™, a revolutionary slide-free cellular analyzer, signals a commitment towards

innovative tech developments.

Idexx Laboratories IDXX News Analytics from Fri, 15 Sep 2023 07:00:00 GMT to Sun, 28 Jul 2024 18:42:33 GMT -

Rating 5

- Innovation 1

- Information 6

- Rumor 3