IDEXX Laboratories Inc. (IDXX) continues to thrive with positive market sentiments and strong standalone growth. Barclays has initiated coverage of IDEXX with an

Overweight Recommendation, highlighting the robust state of the firm. Furthermore, firms like Curi Capital LLC and Daiwa Securities Group Inc. have

increased their positions in IDEXX, signifying a vote of confidence in its prospects. The

strong year-to-date share price surge of IDXX reflects a positive momentum and its stock is considered as a potential

'Moderate Buy' by several brokerages. Despite market fluctuations, IDEXX has proven its resilience and continues to outperform within the

health care sector. Its Q3 2025 earnings reveal

strong revenue growth, likely resulting from the increasing

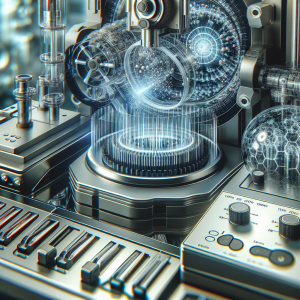

clinical demand and a broad product portfolio. Moreover, it has demonstrated impressive returns over the years - a $1000 investment in IDEXX 20 years ago would have yielded a handsome profit today. An assessment of the company's valuation indicates continued growth prospects and it has been projected to benefit from the adoption of

InVue Cellular Analyzer. Recently, the company further uplifted its full-year outlook following

favorable Q3 results. Looking ahead, IDEXX's

expanded credit facility could shape its next growth phase, underlining a promising future for the company.

Idexx Laboratories IDXX News Analytics from Fri, 02 May 2025 07:00:00 GMT to Sat, 13 Dec 2025 10:47:06 GMT -

Rating 7

- Innovation 8

- Information 7

- Rumor 2