Ingersoll Rand Inc., globally recognized industrial firm, recently reported several significant events influencing its market performance. The company's Q1 earning results topped the estimates but, unfortunately, revenues fell short. Financial forecasts from Robert W. Baird predicted a potential price target increase to $109.00. First Trust Direct Indexing L.P. and Savant Capital LLC, along with several other entities continue to invest in Ingersoll Rand (IR), contributing to its market performance.

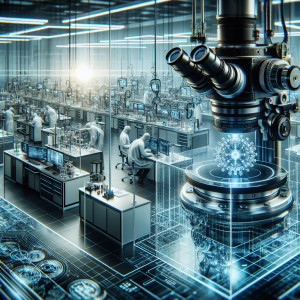

The company's participation in Inkbit's $19M financing round, aiming to enhance multi-functional additive manufacturing, reaffirms its commitment to innovation. However, price gaps and mixed quarterly results raised concerns among some investors. The acquisition of ILC has resulted in the reinforcement of Ingersoll Rand's Life Sciences Unit, underscoring the firm's strategic expansion efforts.

Investors' return on $1000 invested five years back in the company significantly grew by 239%. On the downside, certain entities like Retirement Systems of Alabama and Handelsbanken Fonder AB reduced their stock holdings in IR, signaling mixed investment sentiments. Despite market fluctuations, the intrinsic value of IR sustains as many experts consider Ingersoll Rand a promising growth stock and a wise long-term investment.

Ingersoll Rand IR News Analytics from Mon, 21 Aug 2023 07:00:00 GMT to Tue, 07 May 2024 10:26:44 GMT -

Rating 5

- Innovation 7

- Information 9

- Rumor -3