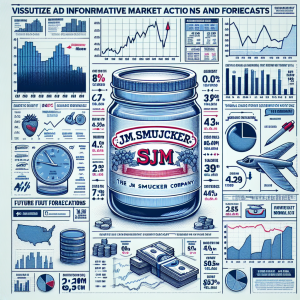

The J.M. Smucker Company (SJM) has encountered numerous fluctuations, including instances of outperforming and underperforming the market. The company's focus on

strategic excellence and strong management of

core categories have marked it as a potential long-term value stock. SJM has experienced

losses but also reports of investors undervaluing it.

The Fiscal 2024

Quarterly results were released, and a new

strategic business area was announced, along with changes in the leadership team. SJM has acquired Hostess Brands to boost convenient consumer occasions and diversify its offering beyond its staple products. Among the noteworthy

divestitures are fermented condiment brands in Canada and the Sahale Snacks® brand.

While SJM is largely institutionally owned, there's concern about recent stock price drops potentially leading to

dramatic actions by owners. The company has announced a dividend and laid off about two dozen employees. Overall, it’s taking on some risk with its debt but remains an attractive prospect for value and momentum investors alike. While some continue to argue the company may be undervalued, new acquisitions may pose financial hurdles in the short term.

The JM Smucker Company SJM News Analytics from Wed, 09 Aug 2023 07:00:00 GMT to Wed, 22 May 2024 21:20:00 GMT -

Rating -2

- Innovation 2

- Information 6

- Rumor -6