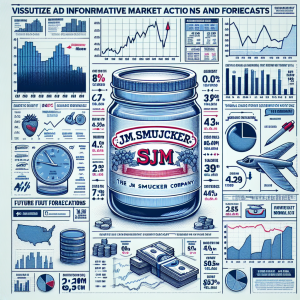

Multiple reports outline the performance of The J. M. Smucker Company (SJM). Analysts hold mixed views with an average 'Hold' recommendation, but few targets have been downgraded.

Stock price showed varied performance, with multiple periods of underperformance.

Earnings generally outperformed estimates despite some sales lagging. Dividends have delighted investors with recent increases. Challenges include rising input costs and indebtedness but, on the positive side,

SJM has benefited from strategic pricing efforts and core strategies. Recent acquisition of Hostess Brands has been an uplifting factor. In general,

institutional investors continue to drive shares, meanwhile, company continues reorganizing its business structure and leadership team. Despite periodic stock price drops, Smucker is

considered an attractive investment by many. Earnings reports and calls disclose

progress in fiscal quarters, but the company carries some financial risk due to its debt level. The

2023-2024 Corporate Equality Index recognized Smucker's attention to human rights. Noticeable layoffs were reported recently, however the company continues its expansion by acquiring new brands. Smucker remains steadfast in its commitment to focusing on core priorities among increasing costs.

The JM Smucker Company SJM News Analytics from Mon, 11 Sep 2023 07:00:00 GMT to Sun, 16 Jun 2024 07:38:37 GMT -

Rating 4

- Innovation 6

- Information 7

- Rumor 0