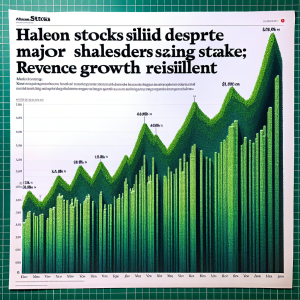

Haleon PLC successfully initiated a

share buyback program, leading to a leap in its share price by

3% following a reveal of an

11% profit increase in the first-half results. This development has triggered numerous stakeholders, including GSK and Pfizer, to sell their Haleon shares. GSK raised

£1.25B and Pfizer approximately

$3.5 Billion from their final sales. Such actions resulted in Haleon's stock hitting new

12-month highs consecutively. On another note, Haleon announced plans to execute a

semi-annual dividend of $0.05; this decision was swiftly followed by the launch of a

£185 Million buyback. Notably, Haleon intends to sell its

nicotine replacement business outside US for $633 million, possibly to sustain its growth and target higher H2 sales amidst existing challenges. Besides, numerous asset management and financial firms, including Bokf Na, O Shaughnessy, and Dynasty Wealth Management, have newly bought, sold, or trimmed their positions in Haleon shares. Despite all this, Haleon is still expected to

post growth and looks forward to the rise of FY results.

Haleon Stocks News Analytics from Thu, 05 Oct 2023 07:00:00 GMT to Sun, 04 Aug 2024 00:10:59 GMT -

Rating 7

- Innovation 0

- Information 8

- Rumor -2