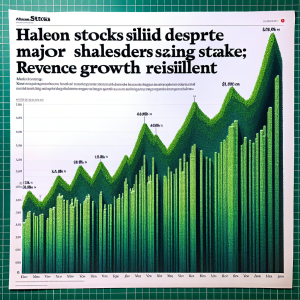

Pfizer, the pharmaceutical giant, has made significant moves involving its assets in Sensodyne-maker

Haleon, selling stakes amounting to more than $3.3 billion. This represented hundreds of millions of Haleon shares and reduced Pfizer's stake to 15%, which was further demonstrated through a large off-market share purchase that Haleon completed. Several headlines point to a share buyback program too. At the same time, Haleon has initiated an equity buyback plan for 455,701,825 shares, indicating an active attempt to strengthen their share value. Despite Pfizer's divestment,

Haleon still maintains an attractive rating from analysts, with UBS Group upgrading it to a strong-buy. Other significant developments include a board member's departure and the resignation of a director. Interestingly,

BlackRock and

Point72 Asset Management have also adjusted their stakes in Haleon, while top-ranking asset manager

Bank of Montreal raised its position. At the end,

GlaxoSmithKline (GSK) follows Pfizer's footsteps, looking to divest its remaining Haleon stake.

Haleon Stocks News Analytics from Wed, 17 Jan 2024 08:00:00 GMT to Fri, 04 Oct 2024 15:48:13 GMT -

Rating 2

- Innovation -5

- Information 8

- Rumor -3