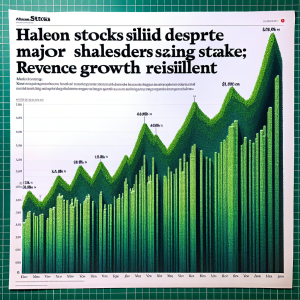

Recent updates reveal extensive movements concerning

Haleon's stock. A significant stride is the completion of the company's

Share Buyback Program, designed to optimize its capital structure and strengthen its market position, which constituted for

805,127 Shares. In addition to

Haleon's positive AGM results in 2025, advancements in its

Capital Management Strategy have also gained recognition, contributing to its strong growth and strategic expansion.

Pfizer, a significant stakeholder, sold its final Haleon Shares, valued around $3.2B, marking its total exit from the company. This was corroborated by a successful off-market deal to buyback shares from Pfizer, completing the buyback program. With a considerable amount of

shares acquired by executives under a reward program, there's an optimistic angle for future growth, despite potential concerns in U.S. demand. Ratings from top financial firms like Barclays, BNP Paribas Exane, and Redburn Atlantic appear bullish for Haleon, with

Morgan Stanley upgrading its own rating for the company. This growing confidence, alongside Haleon's ability to capably handle its debt, cements its stature as a viable investment target.

Haleon Stocks News Analytics from Tue, 01 Oct 2024 07:00:00 GMT to Fri, 06 Jun 2025 14:23:21 GMT -

Rating 6

- Innovation 4

- Information 8

- Rumor -3