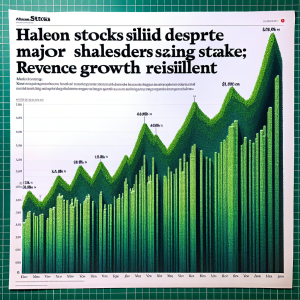

Haleon, a former GSK spin-off, has been making strategic financial moves recently including a consistent

share buyback strategy that has been noted to be a factor in the company's share price waking up. The company has also been undergoing business simplification by offloading brands such as the notorious

Chapstick brand for £400m. The pharmaceutical stock has been categorized as a cheap buy by short sellers. Notably, the company posted a profit increase of 11% in its first-half results, triggering a 3% leap in share prices. However, the company has also encountered setbacks such as plans to shut a UK factory resulting in a loss of 435 jobs. Yet, the ripples in the market piqued interest, leading to both sales and purchases of Haleon stocks by various stakeholders such as

Van ECK Associates Corp,

Banco Santander S.A., and

Quotient Wealth Partners LLC. Amid these developments, GSK has fully divested its stake in Haleon. Pfizer intends to decrease its stake in Haleon from 32% to 24%, resulting in a sell-off of Haleon shares worth roughly £2.6B. Haleon continues to show strong profit growth and financial prospects, with Morgan Stanley adjusting Haleon's shares target concentrating on Q1 growth projections.

Haleon Stocks News Analytics from Fri, 06 Oct 2023 07:00:00 GMT to Sun, 01 Sep 2024 20:15:54 GMT -

Rating 7

- Innovation -5

- Information 8

- Rumor -4