Nvidia and

TSMC shares have surged while

Intel experiences a dip. A vigorous debate around Intel's stock futures prevails, with some believing the technology giant can rebound to $42, while Deutsche Bank lowered Intel's price target to $25 citing near-term headwinds and competitive pressures. Heavy search traffic reveals heightened investor attention. On many occasions, Intel underperformed when compared against competitors even with daily gains; its market activity remained strong nonetheless.

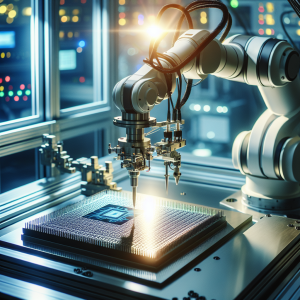

Intel is attempting to recover from a 56% drop Year-To-Date. Several sources suggest it's time to invest due to potential deals, rumoured acquisitions, and purported government funding. However, doubts persist about the likelihood of a Qualcomm takeover, and there are calls for Intel to simplify operations via a potential division of its

foundry operations. Where the stock will stand in a year's time remains a key debate point. This stems from recurring stock slumps, missed Q2 targets, restructuring plans, and debates over whether it will remain in the Dow. Reports of a possible investment offer from Apollo and interest from Qualcomm brought some respite and led to a surge in Intel stock. However, the performance amidst broader market conditions and comparisons with competitors remain mixed.

Intel Stocks News Analytics from Thu, 01 Aug 2024 07:00:00 GMT to Sat, 05 Oct 2024 13:00:00 GMT -

Rating -5

- Innovation -2

- Information 5

- Rumor 2