Intel, a major player in the

chip industry, has seen significant swings in its stock price over the past year. Several factors have influenced these movements, with key influences including

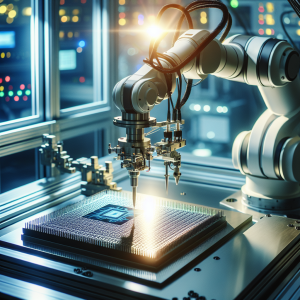

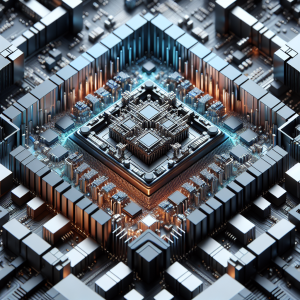

rising AI demand, new microchip developments like the

Panther Lake Core Ultra 3 built on the U.S.'s first 2nm-class node, and potential partnerships. Notable shifts in sentiment have been driven by big-name investments, speculation about becoming

AMD's foundry partner, and launching of their most

advanced technology. However, mixed analyst predictions and uncertainties around foundry and AI issues introduce volatility. Increased competition and possible overperformance leading to unsustainable gains have also been voiced as concerns. Despite this, the company reached a

52-week high at 38.84 USD and unveiled their next-gen chips. Potential future milestones include the announcement of further partnerships and the conclusion of ongoing talks with

AMD. The stock continues to rally despite concerns, capitalizing on highest-ever AI demand, strategic backing from

Nvidia and

SoftBank, and hints at major expansions.

Intel Stocks News Analytics from Mon, 15 Sep 2025 07:00:00 GMT to Sat, 11 Oct 2025 16:43:50 GMT -

Rating 2

- Innovation 9

- Information 5

- Rumor -3