Intel stocks have been showing

significant volatility amid tariff-induced price swings. The shares have undergone tumultuous changes due to the twists in

China tariff saga and leadership uncertainties with the new CEO,

Lip-Bu Tan. Interestingly, the stock has presented a potential generational buying opportunity as it hit a 16-year low and plummeted in response to escalating

US-China trade tensions. With a future financial outlook largely unknown, the

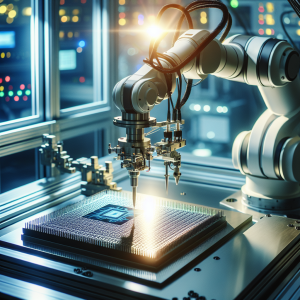

stock could be a trade war winner if it manages to withstand the market challenges. Recent developments including a potential partnership deal with

TSMC (Taiwan Semiconductor Manufacturing Company) have provided optimism for investors, despite a recent tumble. Changes in the

CEO's Chinese investments created significant price movements as the company continues to navigate the continuous economic fluctuations.

Trade-related news remains a key area of uncertainty, swinging the stock towards both ends - strengthening and dipping. Investment experts continue to have differing opinions on whether

now is the right time to buy Intel stocks.

Intel Stocks News Analytics from Wed, 12 Mar 2025 07:00:00 GMT to Sat, 12 Apr 2025 17:19:55 GMT -

Rating -2

- Innovation 7

- Information 8

- Rumor 1