Intel and

Nvidia make headlines as their $5B deal gets clearance from FTC, invoking a rally in their stocks.

Intel's share price wavered amid artificial intelligence (AI) breakthroughs, foundry milestones and Wall Street forecasts but began to surge upon rumors of an Apple deal. Turbulent advances in Intel shares reflect investor apprehension over potential risk and scrutiny from Washington. AI technological progress and foundry pivot in 2025 created an 82% stock surge, offering promising future prospects.

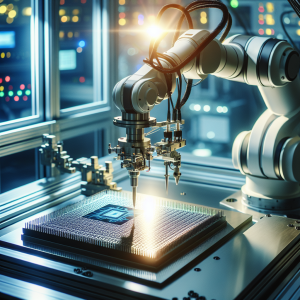

In the sphere of chip manufacturing, a major rivalry between

Intel and Taiwan Semiconductor Manufacturing arose, with speculation over which company would dominate the market in 2026. However, at the dawn of 2026, Intel stock emerged with a strong market position and is predicted to outperform Taiwan Semiconductor Manufacturing. Despite an optimistic forecast, Washington scrutiny and potential risk factors shroud

Intel in uncertainty. Therefore, while some investors buy more Intel shares, others decide to reduce holdings.

The

rumored Apple-Intel chip deal dominated Wall Street speculation, raising questions over whether now is an ideal time to invest. Despite Intel’s impressive 77% annual gains and AI manufacturing progress, the

stock's fluctuating nature keeps investors on their toes.

Intel Stocks News Analytics from Thu, 25 Sep 2025 07:00:00 GMT to Sat, 20 Dec 2025 20:00:00 GMT -

Rating 4

- Innovation 2

- Information 8

- Rumor 5