Southwest Airlines (LUV) will pay a dividend of $0.18, sparking interest in buying the stock. However, the company recently reported a

46% fall in profits and steps are being taken urgently to increase revenue.

Elliott Management, an activist hedge fund, intends to replace majority of Southwest's board, suggesting a potential shakeup. Gradient Investments has increased its position in Southwest. In addition to this, the market seems uncertain about Southwest's future performance.

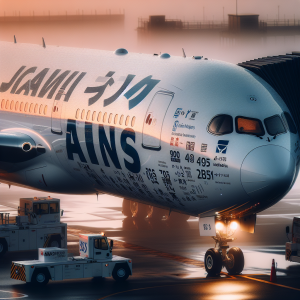

Fresno receives more service from Southwest Airlines to Dallas.

Proxy fight with Elliott Investment is ongoing and there has been a dip in Southwest's Q2 earnings and revenues, with analysts estimating a decline. Elliott Management made a significant investment and announced director candidates for Southwest's board. Amid these developments, Southwest Airlines' stock experienced a drop, despite some market gains. The airline also warns the impact of

Boeing plane delays might continue until 2025. With the recent drop, stakeholders wonder if the stock is still a good buy. There are speculations on whether Southwest Airlines is about to lose its unique positioning with assigned seats and premium upgrades.

Southwest Airlines LUV News Analytics from Wed, 21 Feb 2024 08:00:00 GMT to Sun, 18 Aug 2024 13:39:57 GMT -

Rating 4

- Innovation -3

- Information 8

- Rumor 1