Southwest Airlines has seen a mix of peaks and troughs recently. Despite

underperforming the Nasdaq and facing

macroeconomic uncertainty, the airline's stock climbed by over 5% and even landed a

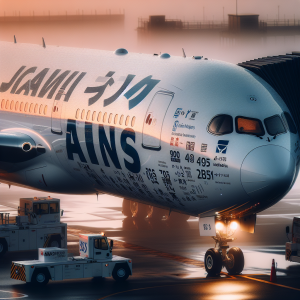

bull rating from Deutsche Bank. Meanwhile, the company has made some strategic changes, such as introducing bag fees, leading to a rise in stock. In a significant move, Southwest announced a

Trans-Pacific partnership with China Airlines, its first. Furthermore,

Honeywell's runway safety technology will be installed across Southwest's entire Boeing 737 fleet, enhancing safety standards. However, Dallas City Council's extension of Southwest's lease for gates at Love Field may cause some turbulence. Alongside, the airline has pulled its

outlook and cut its capacity. Nevertheless, growth potential remains, with Southwest's stock upgraded by Deutsche Bank on the basis of

potential meaningful growth. On another hand, the airline's decision to end free checked bags and

introduction of new fees have stirred mixed reactions. The company is also dealing with lawsuits and

legal woes. Amid all these developments, the dividend for Southwest Airlines will be $0.18.

Southwest Airlines LUV News Analytics from Sat, 11 Jan 2025 08:00:00 GMT to Fri, 20 Jun 2025 13:27:31 GMT -

Rating 3

- Innovation 2

- Information 7

- Rumor -2