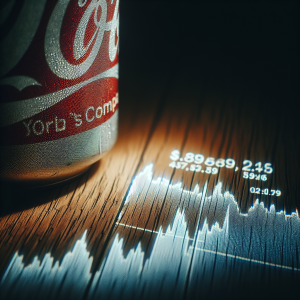

PepsiCo (NASDAQ:PEP) continues to show strong performance despite facing some challenges. Driven by a Q1 earnings beat, the stock is seen to be in uptrend with a golden cross in sight. However, a combination of product recalls and weak lower-income consumer sales have negatively impacted U.S. sales, causing the stock to stumble despite beating expectations. Predictions for Q3 2024 EPS have been lowered, but this isn't preventing some brokers from recommending investment due to potential rebound. Achieving further international growth, PepsiCo beat sales estimates, outperforming the stock market on multiple occasions.

EPS projections for Q1 2024 align with analysts' expectations, with revenue exceeding estimates. Despite occasional dips, PepsiCo's productivity and cost-saving initiatives remain strong and strategic

SWOT insights affirm this position. PepsiCo will also pay a larger dividend than last year at $1.36. As for consumer trends, evidence suggest that PepsiCo is lagging behind some consumer staples stocks. Lastly, a key focus for the company is investment for growth, suggesting a potential long-term strategy, although recent changes to the executive team, like the retirement of North America Beverages CEO, are worth noting.

Pepsico PEP News Analytics from Tue, 10 Oct 2023 07:00:00 GMT to Sat, 11 May 2024 11:00:21 GMT -

Rating 5

- Innovation 7

- Rumor -2