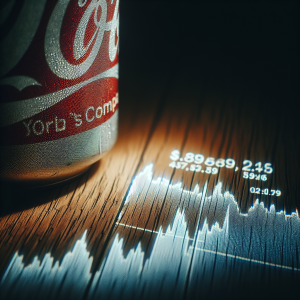

PepsiCo (PEP) is experiencing a significant oscillation in its stock market performance. Several investment firms are developing positions in the company, demonstrating anticipation of company performance improvement. On the other hand, some concerns, including lower sales, tariffs, and consumer spending uncertainties, have led to a reduction in PepsiCo's earnings forecast for 2025, impacting the stock price negatively. Lower than expected Q1 earnings and revenues also added to the bruised image. Coke's higher organic sales than PepsiCo, and concerns about artificial dyes and plastic pollution have put more downside pressure on the firm. Despite this challenging environment,

JIm Cramer has suggested it as a stock to buy given its oversold status. The 4% yield is also attractive to some investors. Highlighting its

defensive nature, several advisors and management firms, including Bison Wealth LLC and Northern Trust Corp, have acquired numerous shares. Lastly, PepsiCo's move towards healthier initiatives such as reducing the usage of artificial dyes and proposing 'Make America Healthy Again' plans have caught some attention.

Pepsico PEP News Analytics from Tue, 25 Mar 2025 07:00:00 GMT to Sat, 03 May 2025 20:26:46 GMT -

Rating -2

- Innovation 1

- Information 5

- Rumor -5