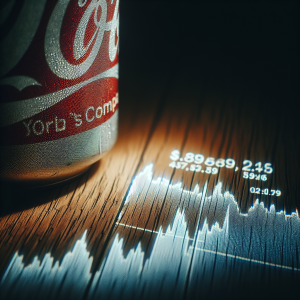

PepsiCo (PEP) is going through a dynamic period with both gains and losses in its stock value, frequently fluctuating slightly below and beyond the board. Regarding future investments, the company recently reached a deal to

acquire Siete Foods for $1.2 billion and has also gained full ownership of Sabra Hummus, reflecting a strategic expansion. Nonetheless, it has seen its stock slide moderately and even touch a 52 week low. The company has been cited by numerous analysts as a strong long-term growth and dividend stock, despite its lows. However, it has illustrated a dip in stock performance in the North American Market impacting Q3 results. Its

dividend payout remains attractive, signaling stable returns for investors. PepsiCo's third-quarter earnings did not meet expectations, leading to the company revising its outlook thrice in 2024. Insiders divesting their 4.2 million dollars worth of shares suggest potential wariness. The bearish sentiment was affirmed by popular critic Jim Cramer. PepsiCo has shown resilience amid these challenges and the sell-off is considered overdone by some. The company's decision to cut its 2024 guidance due to lagging North American sales and other global challenges signals cautious times ahead. Yet, amidst all, possibilities of

strong upside potential are speculated.

Pepsico PEP News Analytics from Thu, 20 Jun 2024 07:00:00 GMT to Fri, 03 Jan 2025 22:19:04 GMT -

Rating -1

- Innovation 5

- Information 7

- Rumor -3