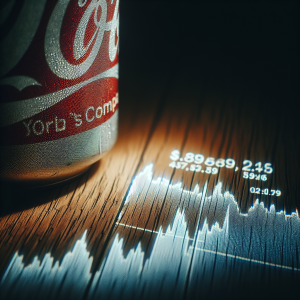

PepsiCo (PEP) exhibits a promising trajectory with sizable

share movements and related activities.

LVM Capital Management has sold 7,463 shares while

Citi keeps a 'buy' rating. There have been concerns about alleged

price-fixing with Walmart. Yet,

JPMorgan Chase recommended buying PepsiCo acknowledging its potential tailwinds. PepsiCo is aiming for

Poppi to be its next billion-dollar beverage brand. Meanwhile,

Barclays uplifts its price target as they anticipate a promising outlook in 2026.

Addenda Capital,

Montecito Bank & Trust,

Osprey Private Wealth, and

Czech National Bank have increased their holdings in PepsiCo, negating the layoffs news suggesting workforce 'right-sizing'. The company declared a quarterly

dividend and announced organizational changes for growth acceleration. Analysts believe shifting consumer trends are reshaping PepsiCo’s outlook. PepsiCo's

innovation pipeline is under examination while amidst consumer trends reshaping its outlook. There has been a

leadership change and a new

Chief Financial Officer.

PepsiCo is also close to settling with

activist investor Elliott.

Pepsico PEP News Analytics from Thu, 17 Jul 2025 07:00:00 GMT to Sat, 20 Dec 2025 11:51:35 GMT -

Rating -2

- Innovation 6

- Information 8

- Rumor 2