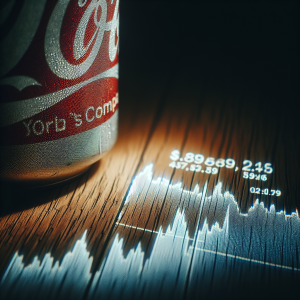

The current buzz about PepsiCo (PEP) reflects both optimism and caution. Financial institutions and individual investors are adjusting their positions: some acquiring more shares, others reducing their stake. The company's recent drop in its P/E valuation has enticed purchasers, viewing it as an opportunity to buy a high-yielding dividend stock at a discount. Also, PepsiCo's dividend continues to rise, indicating long-term stability. Notwithstanding, there are intimidating facts with Wells Fargo not seeing 'fizz' amid concerns over profitability, coupled with a lawsuit over plastic waste accumulation.

While Q1 results topped estimates, fears overwhelm some investors due to soft demand, increased costs and a gloomy economic outlook–resulting in a slide in late trading. The company's decision to lower their earnings forecast seems to be a response to impending tariffs and speculative consumer spending. However, there's high expectation regarding the recent acquisition of poppi, a shift towards functional beverages market. Nonetheless, with a notable 77% institutional ownership, the company's direction will be largely controlled by these stakeholders.

Pepsico PEP News Analytics from Sun, 23 Mar 2025 07:00:00 GMT to Sat, 07 Jun 2025 12:56:04 GMT - Innovation 3 - Information 8 - Rumor -5