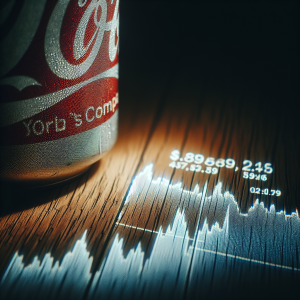

PepsiCo continues to be a strong player in the global beverage market, despite facing challenges. Recent novelties report an undervaluation of

PepsiCo stock and its resilience amid market turbulences, netting respectable returns for investors. The company's strategy,

PEP+, is showing positive results and an appeal to both new and existing investors. Yet, some financial advice turns bearish, citing rising difficulties, and suggesting it might not be an ideal time to invest for dividends. Several asset management firms are altering their stake in

PepsiCo, with many increasing their holdings, signalling a possible bullish trend. However, it is also noted that some insiders have sold a significant amount of shares. Positive outcomes include that the company exceeded Q3 earnings estimates, and it has struck a deal to buy

Sabra Hummus fully. At the same time, it is looking into acquiring

Siete Foods. Nevertheless, concerns arise from trimmed growth outlook due to volume slipping, discrepancy between actual sales and stock price, and lowered sales forecast because consumers are reining in on snack and soda expenses.

Pepsico PEP News Analytics from Thu, 20 Jun 2024 07:00:00 GMT to Sat, 07 Dec 2024 12:30:00 GMT -

Rating 0

- Innovation 4

- Information 5

- Rumor -2