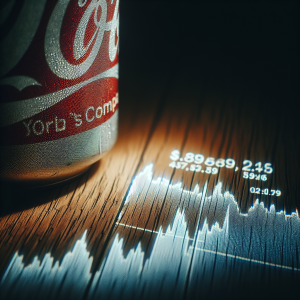

PepsiCo (PEP) experiences both growth and challenges in recent topics. Share price has been noted to drift lower, however, despite this dip, some believe the company currently provides value. Although particular risks have been presented, PEP’s dividends seem to offer stability for shareholders. Some potential issues may haunt the stock according to experts, yet acquisitions by various entities have risen with

Cwm LLC,

Highland Capital Management LLC, and

Brookstone Capital Management increasing their holdings. However, some sold their shares, including

Pacer Advisors Inc and

Canoe Financial LP.

Barclays lifted PEP's price target, indicating a positive 2026 outlook. While various financial entities reshaped or decreased their stake, the company's international markets are fueling sales growth. The announcement of a new

Chief Financial Officer is among the latest developments while a class action lawsuit over alleged price-fixing has been filed against PepsiCo and

Walmart. Despite certain setbacks, JPMorgan Chase endorses buying PEP, stating several tailwinds for the stock. Barclays reiterated a brighter outlook for 2026, leading to an increased PEP valuation. Lastly, PepsiCo continues to focus on its PEP+ sustainability and nutrition goals as part of its strategic vision.

Pepsico PEP News Analytics from Thu, 17 Jul 2025 07:00:00 GMT to Sat, 27 Dec 2025 16:48:17 GMT -

Rating -2

- Innovation 3

- Information 4

- Rumor -5