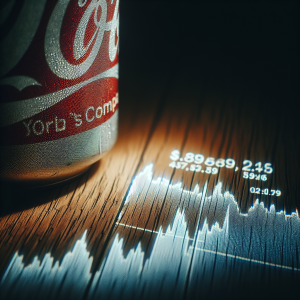

The preeminent beverage company, PepsiCo (PEP), undergoes a series of market fluctuations and investor actions. While the company has had successes and positive moves, such as asset acquisitions by multiple asset management firms and increased dividend yields, these achievements are not without their set of complications. Despite the dividend yield peaking at 4.4%, raising concerns over the dividend's stability, the stock remains undervalued, according to statements made by Rep. Julie Johnson and Jim Cramer. The stock also hit a 52-week low, further fueling speculation and fears surrounding the company's current market position.

Legal scrutiny has marred PepsiCo as a result of excessive plastic waste contribution, with both Coca-Cola and PepsiCo being sued. This instability continues as PepsiCo's 2025 earnings forecast cuts its annual profit outlook as future tariffs are expected to increase costs. However, the company’s initiative to accelerate digital transformation in collaboration with AWS shows innovation in its business model.

Even so, the firm continues to face market pressure, with its stock price declining multiple times recently, prompting investors to question whether to hold, sell or buy the dip. Amid these concerns, PepsiCo continues its streak of increasing shareholder's dividends for the 53rd consecutive year.

Pepsico PEP News Analytics from Tue, 25 Mar 2025 07:00:00 GMT to Sat, 17 May 2025 19:20:32 GMT - Rating 0 - Innovation 2 - Information 4 - Rumor -6