Recent news around Palo Alto Networks (NASDAQ:PANW) paints a compelling picture of its market performance and potential future growth. The company has made a significant AI push, unveiling comprehensive Security Access Service Edge (SASE) capabilities and a series of autonomous cybersecurity solutions across multiple platforms. Palo Alto has also announced a slew of strategic missions, like harnessing precision AI for advanced threat defense and unveiling the precision AI powered SOC, Cortex XSIAM.

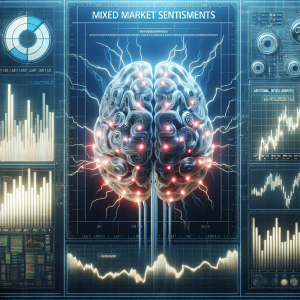

On the investment front, a Wall Street Analyst has projected the company's stock price could reach $360. However, there have been concerns on the company's stock performance due to a dip despite market gains. One of the main highlights includes the announcement of the intrinsic value potentially being 36% above its share price, sparking interest among investors.

Despite these advancements, Palo Alto's stock has recently experienced significant decreases. High-profile investors believe despite these dips, Palo Alto is a good buy. This mixed perception depicts a volatile, yet promising outlook for PANW.

Furthermore, bearish sentiments have been echoed in news of the company's billings decelerating leading to a plunge in stock prices. There is also speculation about the competition becoming fiercer. Despite this, the company's EPS growth and impressive response to past challenges make a strong case for its potential as an attractive investment.

Palo Alto Networks PANW News Analytics from Wed, 27 Dec 2023 08:00:00 GMT to Wed, 08 May 2024 02:52:39 GMT - Rating 3 - Innovation 5 - Information 8 - Rumor -4