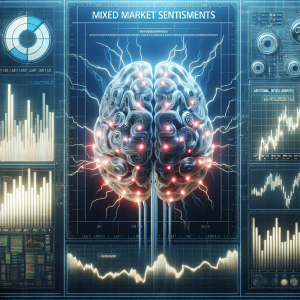

Palo Alto Networks (NASDAQ:PANW) has seen a mix of positive and negative sentiments recently. Their

unusual options activity for May 29 and the interest shown by institutional owners who hold

78% of the company, indicates a steady investor confidence. The company's laid-out

AI strategy and potential buy opportunities suggest positive growth. However, their shares led a broader

cybersecurity selloff and their

earnings repeatedly tumbled, offering chances to buy at dips. Their

price target was increased to $348.00 by Argus, despite

disappointing billings outlook and their stock sunk as markets gained. Insiders sold stocks contributing to a slide, nevertheless arguments for investing in PANW keep surfacing, specifying it to be based on bullish Wall Street views. With every

earnings and revenue beat, skepticism surrounds their financial performance with worries of a downward spiral. Their expanded partnership with

Google Cloud to revolutionize

cybersecurity with AI is a significant move. Analyst opinions on whether PANW is a buy, veer with the company's performance fluctuations. Despite the latest

stock plunge following a guidance slash, future prospects for the company remain conceivable.

Palo Alto Networks PANW News Analytics from Tue, 20 Feb 2024 08:00:00 GMT to Thu, 30 May 2024 14:52:14 GMT -

Rating 2

- Innovation -4

- Information 6

- Rumor -8