Palo Alto Networks (PANW) consistently outperforms the technology sector, showing potential for growth with its AI-driven cybersecurity innovations. The

stock is touching new peaks and its forecasts suggest more wins are coming as the

firm topped estimates and approved a stock split. On the flip side, a lawsuit update urged investors who lost money to contact the Shareholders Foundation, while Insider Sell reports suggested heavy sales by high-profile individuals, including Director Carl Eschenbach. Notably, PANW's Q1 results were robust, underpins by margin expansion, and Wall Street remains confident in the stock. The company utilizes AI technology for cybersecurity resilience, and its

AI-Powered Cybersecurity drives powerful growth. Various

analysts have adjusted stock prices in the light of its earnings reports and growth prospects. Despite some market volatility and stock dips, the overall outlook for PANW is bullish. Their Q1 2025 earnings report highlights strong revenue growth, and surveys show increasing IT spending. Furthermore, Argus has raised its price target on PANW post strong Q1 revenue growth. Lastly,

Jim Cramer, American television personality, and former hedge fund manager stated that Palo Alto Networks CEO,

Nikesh Arora, is extremely competitive and hates to lose.

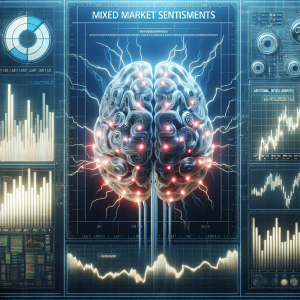

Palo Alto Networks PANW News Analytics from Sun, 18 Aug 2024 07:00:00 GMT to Fri, 06 Dec 2024 21:14:00 GMT -

Rating 9

- Innovation 7

- Information 8

- Rumor -3