Palo Alto Networks (PANW) continues to gain

investment traction with positive evaluations hinting towards substantial future returns. Institutional

investors control 78% of the cybersecurity firm, encouraging an impressive stock increase of 9.6%. Even with a recent US$13b market cap loss, shareholders have still observed a 418% rise over five years. Speculations suggest an impending

AI-led acquisition to the company's portfolio, while market strategies include a multiyear partnership with NHL and continually increasing activity in options. Financial performance displays resilience despite market fluctuations. The company maintains a place on the top of cybersecurity stocks, reporting $1.5 billion in sales on Google Cloud Marketplace. Key insiders, including CFO Dipak Golechha and EVP Lee Klarich, however, have sold substantial amounts of stock. Even amidst industry concerns, the firm's introduction of

Cortex Cloud strategy and incorporating AI-driven cybersecurity draws attention. According to Baird's recent analysis, next-generation security growth and increased investor attention support raising the stock price target to $230.

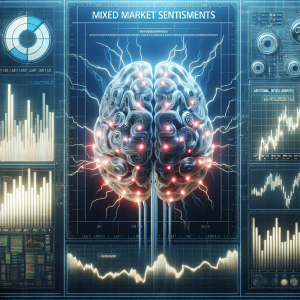

Palo Alto Networks PANW News Analytics from Thu, 23 Jan 2025 08:00:00 GMT to Sat, 26 Apr 2025 15:26:00 GMT -

Rating 5

- Innovation 6

- Information 8

- Rumor -2