Palo Alto Networks, a trend-setting cybersecurity firm, has been noteworthy in market activity. Their stock positioning has increased due to actions by

RFG Advisory LLC and

Churchill Management Corp, contributing to their market momentum. The company's strong fundamentals seem to be a factor in their recent stock performance. Advisors and analysts like

DA Davidson and

Cantor Fitzgerald have given the company positive ratings, recommending 'Buy' and 'Overweight' respectively. Their expanded partnership with

Google Cloud to revolutionize cybersecurity with AI is a significant move. Their recent earnings and revenue estimates exceeded expectations. However, their stock fell despite these, potentially due to an unimpressive forecast. Insider sales by director

John Key took place, adding to the market buzz. Post-earnings, their stock witnessed a plunge, causing concerns. Their strong momentum did cause their RS Ratings to climb, keeping investor interest alive. Analysts have rebooted their stock price target, and their outlook appears brighter due to their AI transformation journey developed with

Accenture. However, disappointing billings guidance led to a fall in their stock. Ahead of their earnings report, the market watches for growth in EPS, expecting positive results.

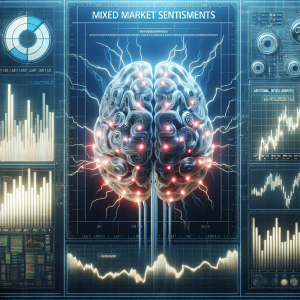

Palo Alto Networks PANW News Analytics from Tue, 20 Feb 2024 08:00:00 GMT to Sun, 23 Jun 2024 23:08:00 GMT -

Rating 0

- Innovation 6

- Information 5

- Rumor -6