Palo Alto Networks (PANW) is a dominant player in the

cybersecurity business, however, the current concerns about its future performance have led to a major setback. A recent surge in

deferred billings has taken a toll on the firm’s

free cash flow, which has sparked a slowdown in growth. Meanwhile, the Q3 2024 earnings beat expectations and the revenue outlook has been deemed satisfactory. A setback was experienced when the company saw its stocks drop by 9% following a disappointing

billings outlook. PANW's partnership with IBM to provide AI-powered security offerings bodes well for the future of the company. Despite the mixed reactions and temporary setbacks, PANW reported strong momentum and was upgraded to a strong-buy. The company has recently announced their

AI Strategy, positioning itself as an innovative force in cybersecurity. On a market sentiment basis, those who invested in Palo Alto Networks five years ago have seen a 357% increase. Analysts remain divided on PANW with some forecasting a bright technical outlook and others seeing the shares sliding. The company's stock is favored by

institutional owners who hold a significant percentage of the company.

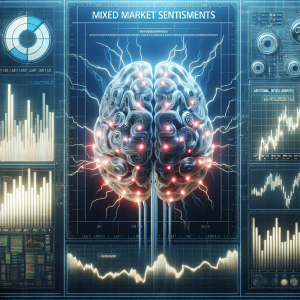

Palo Alto Networks PANW News Analytics from Fri, 12 Jan 2024 08:00:00 GMT to Mon, 03 Jun 2024 00:00:00 GMT -

Rating 2

- Innovation 5

- Information 7

- Rumor -5