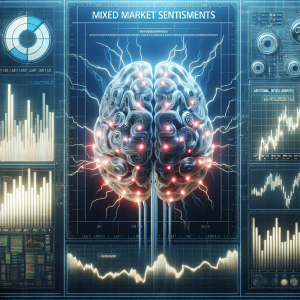

Palo Alto Networks (PANW) stock saw a notable

15% increase last month. Various events and aspects influenced this change, including the expansion of the company's position by

Norden Group LLC, positive

Q1 earnings, and recognition in the

S&P 500. The company has made strides in

AI Cybersecurity, while some shares were sold by insiders. Analysts have predicted more than

20% growth, and top funds add to their positions due to

PANW's sparse debt use. However, the

billings outlook fell short of expectations, triggering a 9% stock drop. PANW also expanded its partnership with

Google Cloud to revolutionize cybersecurity with AI, yet the forecast fails to impress, causing the stock to fall after earnings. Despite its

high institutional ownership and

strong fundamentals, the stock tumbled following disappointing sales forecast. Even as PANW's earnings and revenue estimates top Q3, concerns linger about its billings guidance. Meanwhile, PANW aims to secure the Gen AI transformation journey with

Accenture and continues to draw investor attention even as the stock sees a renewed technical strength. The downside risk remains elevated, and there is a warning about PANW effectively absorbing tailwinds. However, PANW's returns on capital are heading higher.

Palo Alto Networks PANW News Analytics from Tue, 20 Feb 2024 08:00:00 GMT to Sat, 06 Jul 2024 00:12:25 GMT -

Rating 5

- Innovation 6

- Information 7

- Rumor -7