Manchester Capital Management LLC and

Wealthspire Advisors LLC stocked up shares of

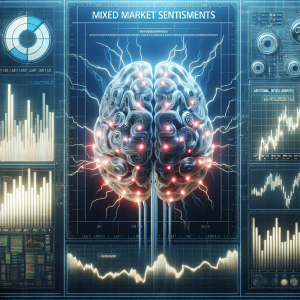

Palo Alto Networks, Inc. (PANW). In spite of market gains and beating

Q3 earnings and

revenue estimates,

PANW's stock has seen a mix of fluctuations prompting incisiveness amongst investors. The company's expansion of partnership with

Google Cloud in integrating AI-revolutionized cybersecurity has led to the stock being hailed as the 'Best of Breed Bison'. There has been insider selling, attributed to a disappointing billings outlook, causing PANW's share price to take resultant dips. It also faced a broader cybersecurity selloff, alongside

Zscaler. The aftermath of a disappointing sales forecast, resulted in

PANW sinking on guidance again. Despite analyst reboots, renewed technical strength, strong fundamentals and beating expectations, investor anticipation and scope for stock plunge loom large. Potential buy signals exist in the light of PALO's recent bond with

Accenture to secure AI transformation journey, and prospects of stock performance correlating to its revenues. However, downside risk is evident and the stock's turnaround is left ambiguously pending. Despite this, bullish Wall Street views recommend an investment in

PANW.

Palo Alto Networks PANW News Analytics from Tue, 20 Feb 2024 08:00:00 GMT to Sun, 14 Jul 2024 12:38:28 GMT -

Rating -2

- Innovation 2

- Information 5

- Rumor -3