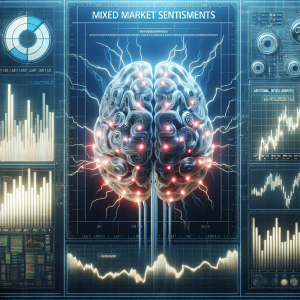

Palo Alto Networks (PANW) has been garnering increasing attention from investors and analysts lately. The cyber security company has recently reported its

Fiscal Third Quarter 2025 Financial Results, which received mixed reviews. While the company surpassed earnings and revenue expectations, its gross margin fell short, subsequently causing the stock price to dip. In response to these developments, multiple analysts have maintained a strong 'buy' rating for PANW, voicing confidence in the company's potential for long-term growth - a sentiment shared by the company's many institutional investors.

On the innovation front,

Palo Alto isn't standing still. The company's relentless pursuit of new frontiers in cyber security is evident from recent moves to bolster its next-generation security and artificial intelligence (AI) portfolio. Notably, Palo Alto expressed its intent to acquire

Protect AI - a potential game-changer in the cyber security landscape. Enhancements in AI-powered security systems and collaboration with powerhouse entities such as AT&T continue to carve a growth path for the company. Despite revealing cautious investor sentiment in reaction to factors like high PE ratios and the recent earnings dip, PANW's fundamental outlook remains positive. The market's fervor for PANW is unlikely to wane, given their spectrum of inimitable offerings and high forecasted earnings growth.

Palo Alto Networks PANW News Analytics from Mon, 10 Feb 2025 08:00:00 GMT to Fri, 30 May 2025 11:30:37 GMT -

Rating 6

- Innovation 7

- Information 8

- Rumor 2